Robinhood recently launched its Stock Lending program to users. So, what is stock lending, and is it right for you? Read on to get the scoop.

Share lending is nothing new- in fact it’s been around as long as short sellers have needed to borrow shares to take short positions. Before Robinhood launched this program, shares held in your Robinhood margin account could still be lent out to short sellers but you had no way of knowing which shares were being borrowed and you didn’t make any money off of this.

Read here to learn how to switch your Robinhood margin account to a cash account.

After the whole GameStop (GME) short squeeze debacle in 2021, Robinhood came under a lot of scrutiny for its inner workings. I suspect this new share lending program has emerged on the Robinhood platform because people are simply demanding greater transparency and control with their brokerage accounts. And, one of Robinhood’s big competitors, Webull, has had a stock lending program that offers an avenue for passive income that predates the 2021 GME short squeeze event.

Pros and Cons of Enrolling in Stock Lending

The main reason you would want to enroll in Stock Lending is for the potential to earn passive income. If you are holding shares long term rather than actively trading, you may want to see if you can earn some extra income since you’re going to be holding those shares for a long time. How much can you make from enrolling in Stock Lending? The reality is that you need a fairly large sum of purchased stocks sitting in your Robinhood account to make any money. Robinhood offers this hypothetical scenario in which someone with $10,000 worth of securities earns $150 per year if their shares are on loan through this program.

If your shares are borrowed by someone through stock lending you:

- still receive any dividends you would otherwise

- earn a small cut of the broker’s fee paid by the person/entity borrowing your shares

- can still sell your shares at any time

- are NOT able to vote on proposals while your stocks are being loaned

The main reason you would not want to enroll in Robinhood’s Stock Lending program is that you have an interest in participating in stock holder voting opportunities for the company or you do not want to facilitate the short selling of the stock you are invested in.

How to Find Your Income from Stock Lending

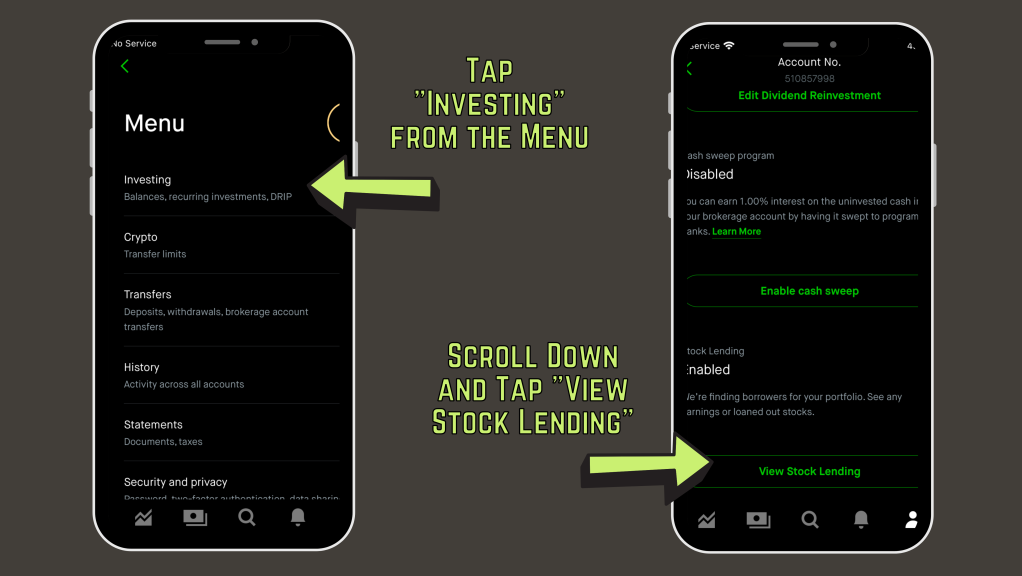

Go to your Menu by tapping the three lines in the upper left corner of your profile page in the mobile app. This will bring up your Menu and then you’ll tap “Investing” which is the first option. Then, you’ll need to scroll down to “Stock Lending” and tap View Stock Lending.

This will show you how much you’ve earned through the program so far and for just the past month. Interest earned through the Stock Lending program is paid out monthly to your brokerage account. You will also be able to see which stocks are currently on loan. Note that you are not able to pick and choose which stocks can be loaned out and by enrolling, you are allowing all of your positions to be borrowed.

How to Disable Share Lending on Robinhood

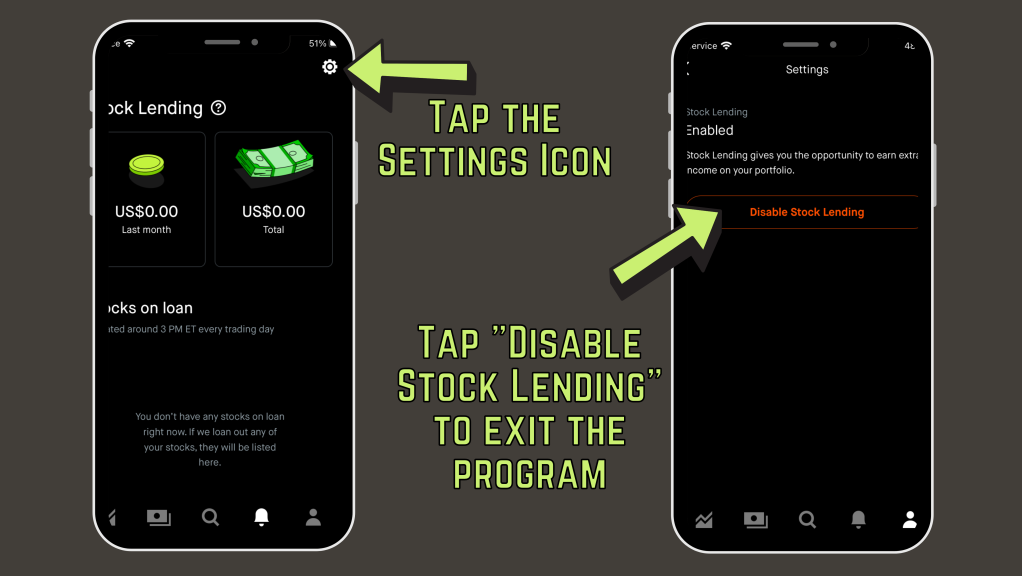

Follow the steps above to get to “View Stock Lending” so that you are the screen seen in the image below. Then, tap the Settings Icon in the top right. Select “Disable Stock Lending” to prevent any more of your shares from being loaned.

If you do disable Stock Lending, you are able to opt back in at any time. You will be paid out any earned interest income for your time in the program if you do opt out.